Will my drivers be able to use the new digital driving licence in Europe or will they still need to produce a physical driving licence?

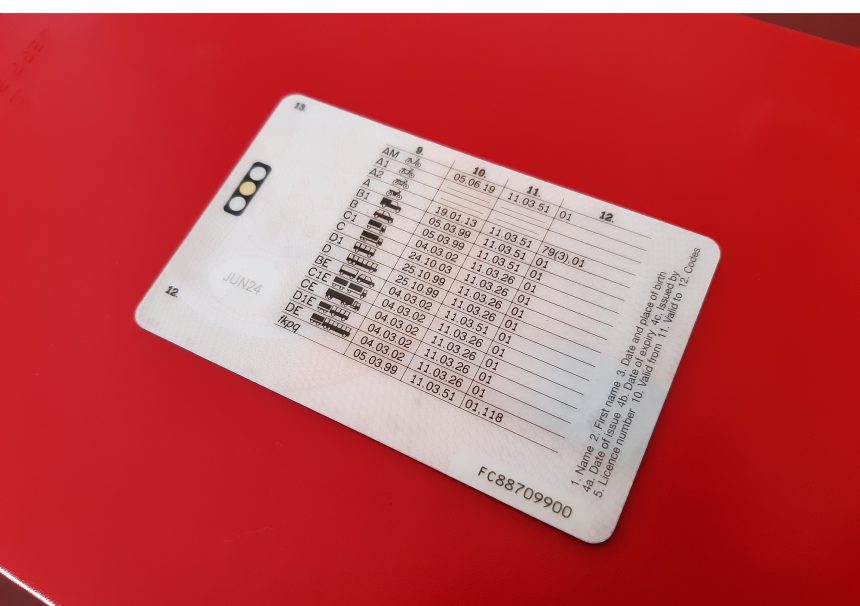

Digital driving licences are to be introduced in the UK later this year as part of a government initiative to launch a GOV.UK Wallet and App to simplify access to official documents.

A digital driving licence is expected to be one of the first digital documents available in the GOV.UK Wallet (after a digital Veteran Card) launching this summer and will allow people to prove their entitlement to drive from their phone.

The GOV.UK Wallet will permit individuals to securely store government-issued documents on their phone and use them easily when needed. The technology will use features found on many smartphones, such as facial recognition, fingerprint checks and multifactor authentication (similar to those used when people pay using a digital bank card) to ensure digital documents are secure, even if a device is lost.

Traditional physical documents will remain available for those who prefer them.

The GOV.UK Wallet is expected to expand to include a wide array of government-issued credentials, such as DBS checks, with all government services required to offer digital alternatives to paper and card credentials by the end of 2027, but it is not thought physical identification will be replaced entirely.

Virtual driving licences are already in use in some European countries and every EU member state is required to introduce at least one form of digital ID by 2026; however, the government’s announcement extends only to the use of digital driving licences within the UK.

International coach drivers are therefore advised to still carry their physical driving licence, as there is no guarantee that a digital driving licence will be recognised or accepted by European enforcement agencies.

What do I need to know about the changes to pay coming in April?

From April, most operators will face higher payroll costs. Operators should therefore review and update their rates of pay and policies to ensure they are compliant.

Some of the key changes include:

Increase in National Minimum Wage (NMW) and National Living Wage (NLW) rates

From 1 April:

- the NLW will increase for those aged 21 and over by 6.7% (£0.77) to £12.21.

- the NMW rate for 18-20-year-olds sees a larger increase of 16.3% (£1.40) to £10.00.

- the NMW rate for 16-17-year-olds and the apprentice rate will increase by 18% (£1.15) to £7.55.

Increases to statutory rates

Statutory maternity, paternity, shared parental, bereavement and adoption pay will increase by 1.69%, from £184.03 to £187.18.

Statutory sick pay will also increase by 1.69%, from £116.75 to £118.75.

The lower earnings limit (in other words, the minimum an employee needs to earn to qualify for these payments) will also increase from £123 to £125.

There has been no announcement from the government relating to the weekly pay cap for statutory redundancy calculations, but any change that might be announced in the coming weeks will likely be effective from April.

Changes to Employer’s National Insurance Contributions (NICs)

In line with the promises set out in the Labour manifesto, the Chancellor confirmed there would be no changes to National Insurance, VAT and income tax for working people. However, there will be an increase in the rate of employer’s NICs from 6 April. This will increase by 1.2% from 13.8%, bringing it up to 15%. The threshold at which employers start to pay NICs for their employees will also drop from £9,100 to £5,000.

The government has also increased the maximum Employment Allowance (which is designed to help eligible operators reduce their National Insurance liability). Operators can currently claim up to £5,000 per tax year but, from April, this will increase to £10,500.

[Answers by Laura Hadzik, Partner, and Rachel Steel, Solicitor, JMW Solicitors]