A worsening macroeconomic outlook dampened global oil demand in December 2023, and global oversupply alongside potential supply disruption caused by escalating Middle East tensions indicated a mixed outlook.

In the US, oil supply growth continued to defy expectations, and the Joe Biden administration continued its replenishment strategy for the Strategic Petroleum Reserve. Additionally, the International Energy Agency (IEA) highlighted record Brazilian and Guyanese production along with surging Iranian flows.

Increased supply alongside scepticism over the effectiveness of OPEC+ output cuts, despite Russia and Saudi Arabia attempting to encourage all other producers in the group to join the cuts to support prices, outweighed Middle East related supply concerns. As a result, a seven-week decline in Brent occurred for the first time in five years, falling to the lowest price since July at US$73 per barrel by mid-month.

Signs of higher interest rates impacting the global economy could be seen as the demand sentiment worsened in December 2023, indicated by JP Morgan reporting that global oil consumption grew at the slowest pace in nine months.

China’s crude oil imports declined due to surging prices earlier in the year, as crude arriving in December and January would have been bought at higher prices. The IEA revised global demand growth down for Q4 2023 in its December Oil Market Report, citing a further weakening of the macroeconomic climate. However, OPEC maintained its oil demand growth forecast, blaming the recent price drop on “exaggerated concerns” about oil demand.

Towards the end of December 2023, Iran-backed Houthi attacks on commercial vessels in the Red Sea prompted oil major BP and shipping giants MSC, Hapag-Lloyd, CMA CGM and Maersk, amongst others, to pause shipments through the Red Sea and Suez Canal, and the US announced a new maritime task force to protect commercial vessels.

Although Brent briefly recovered to almost US$80 per barrel, prices declined again after some shipping firms started to resume crossing the Red Sea route, despite persistent tensions in the Middle East.

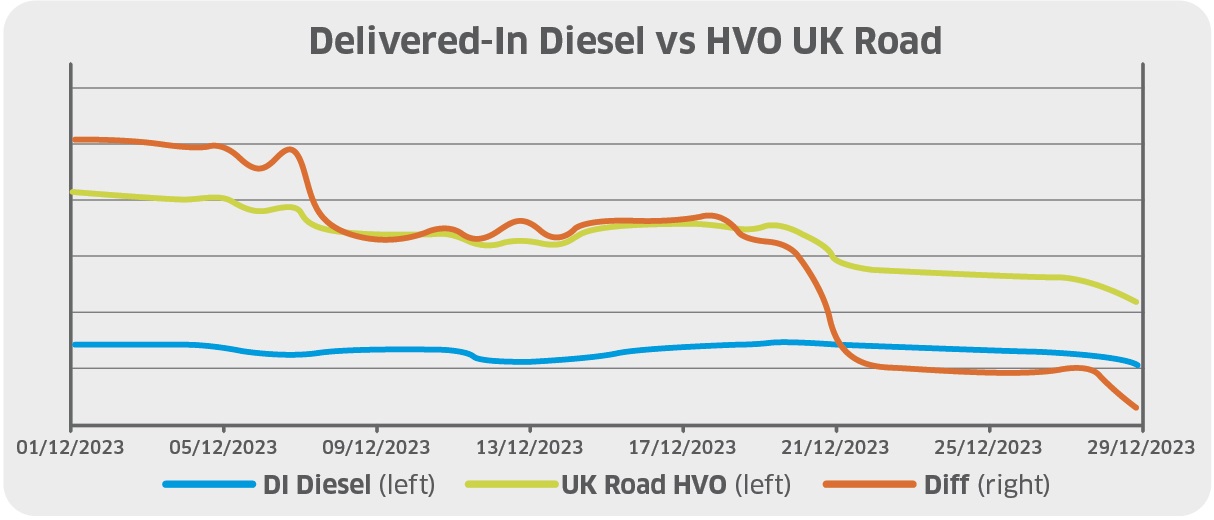

Overall, Brent declined by US$2 per barrel to close 2023 at US$77 per barrel, recovering from US$73 per barrel earlier in the month. Portland Pricing’s index highlighted that delivered-in diesel declined from 114ppl to 112ppl, following a similar trajectory to its underlying benchmark, Brent crude.

GBP also contributed marginally to the falling diesel price, as the pound strengthened to $1.275 against USD across December 2023, near its highest rate since August of that year. Although key economic data revealed that the UK is facing slow growth, consumer price index inflation fell to a two-year low of 3.9% in November.

The Bank of England maintained interest rates at 5% during the final monetary policy meeting of the year, and investors expect cuts to begin in 2024. However, revised figures released towards the end of December 2023 indicated a potential recession, with the economy contracting by 0.1% between July and September last year.

Meanwhile, a weakened US dollar also boosted the pound with hints from the US Federal Reserve about an aggressive rate cut plan for 2024. GBP appreciated by around one cent across December, equating to a decline of less than 1ppl in the price of UK diesel, based on current wholesale diesel prices.

The cost to blend biodiesel (typically using methyl ester bioproduct) to the UK standard of 7% biodiesel (B7 specification) increased by c.1ppl to reach almost 4ppl by the end of December 2023, limiting the extent that commercial bulk diesel prices fell.

Finally, the renewable diesel (HVO) price saw a considerable drop throughout the month, from 141ppl to 123ppl. As diesel prices only fell marginally in comparison, and Renewable Transport Fuel Certificates climbed towards 20ppl from 15ppl (increasing the benefit that HVO consumers receive), the premium for renewable diesel over traditional fossil diesel narrowed significantly from 27ppl to 11ppl by month-end.

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information visit its website.