Brent crude rose by around 2% from February’s close to the first day of March to trade at US$83.50 per barrel, following expectations that OPEC+ would tighten supply.

The producer group later confirmed a 2.2 million barrel per day increase in voluntary output cuts until Q2, to combat rising non-OPEC production in the United States, Guyana, Brazil and Canada, all of which are producing at record high levels.

The demand sentiment remained uncertain in March, as China’s faltering economic recovery continued despite the introduction of stimulus measures. The China National Petroleum Corporation claimed that the top oil importer was in a low-growth phase due to decarbonisation targets dampening fossil fuel consumption.

Although OPEC maintained a strong oil demand growth forecast for this year and next, Brent crude slid to US$82 per barrel by mid-month.

However, persistent geopolitical tensions supported oil prices. Ukraine conducted drone attacks on several Russian refineries, impacting an estimated 12% of Russia’s total capacity in March. The energy war continued to escalate, as Russia retaliated by targeting Ukraine’s critical energy infrastructure.

In the Middle East, Red Sea attacks intensified and although the US Security Council demanded an immediate ceasefire, Israel recalled negotiators from Qatar. As a result of ongoing tensions causing supply concerns, Brent crude rose above US$87 per barrel, despite a weaker demand sentiment.

Towards the end of March, initial data from the final American Petroleum Institute report of the month highlighted a 9.3 million barrel increase in US crude stockpiles, causing oil prices to decline on the back of weak demand.

However, the Energy Information Administration report showed that US reserves rose by a much less significant 3.2 million barrels, suggesting that demand was not as weak as originally anticipated. Overall, Brent crude closed the month at US$87 per barrel, and delivered-in diesel prices declined marginally from 117ppl to 116ppl throughout March, according to Portland Pricing’s index.

GBP depreciated marginally from US$1.265 to US$1.263 in March and therefore had little impact on UK diesel prices. However, the pound had reached its highest level since July 2023 by mid-month at US$1.288.

The British Chambers of Commerce raised growth forecasts for 2024 and 2025, and Ernst and Young projected lower inflation and a stronger labour market. Additionally, Chancellor Jeremy Hunt announced expansionary fiscal measures including tax cuts to boost the economy.

GDP rose for the first time since a recession was declared, indicating a resilient UK economy. As a result, the Bank of England maintained interest rates at 5.25%, and many investors expected the central bank to continue delaying interest rate cuts, strengthening the pound.

However, data revealed that inflation unexpectedly fell to 3.4% in February, and the central bank hinted at upcoming cuts this year. Meanwhile, the US Federal Reserve also paused interest rates, although inflation remained higher than expected. Overall, GBP depreciated marginally across March to close at US$1.263.

The cost to blend biodiesel (traditionally using methyl ester bioproduct) to the UK standard of 7% biodiesel (B7 specification) increased from 3ppl to 4ppl, marginally raising commercial bulk diesel prices.

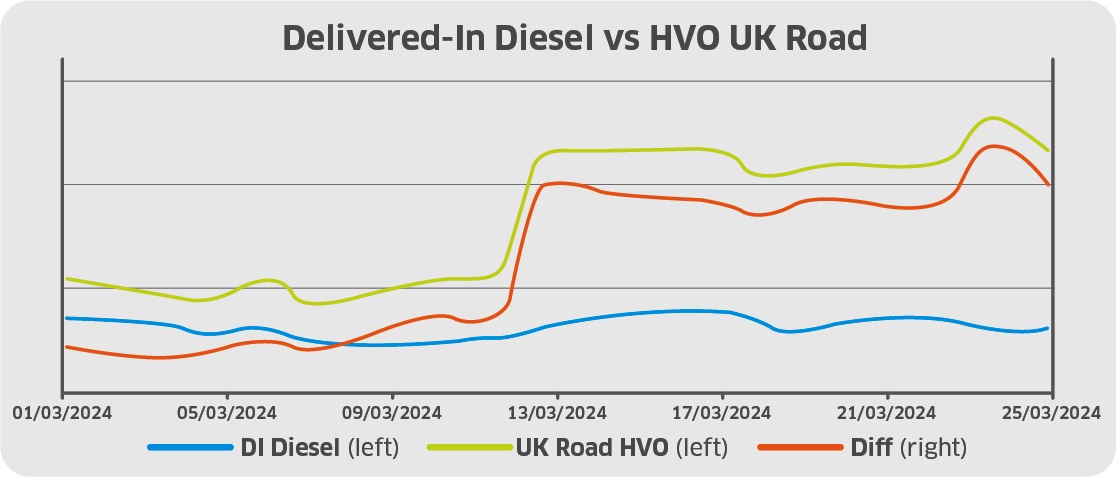

Finally, wholesale renewable diesel (HVO) prices rose from c.121ppl to c.133ppl throughout March. Additionally, the price of Renewable Transport Fuel Certificates (RTFCs) increased marginally to 16ppl, slightly increasing the benefit that HVO consumers receive (assuming that 100% of the RTFC benefit is passed onto the end-user).

As delivered-in diesel prices remained virtually unchanged with a 1ppl decline, compared to wholesale HVO (excluding premiums) increasing by 12ppl, the differential between the wholesale renewable diesel price and the delivered-in price widened significantly in March.

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information visit its website.