At the beginning of October, supply constraints caused by OPEC+ majors Saudi Arabia and Russia reaffirming their plans to continue voluntary output cuts of 1.3 million barrels per day until year end were partially eased following Russia’s decision to lift its diesel exports ban originally introduced in September.

Additionally, a weak global demand sentiment caused by persistently high interest rates was exacerbated by the World Bank reducing the 2024 growth forecast of top crude oil importer China. The aforementioned supply and demand factors caused Brent crude to decline by $7 per barrel during the first week of October.

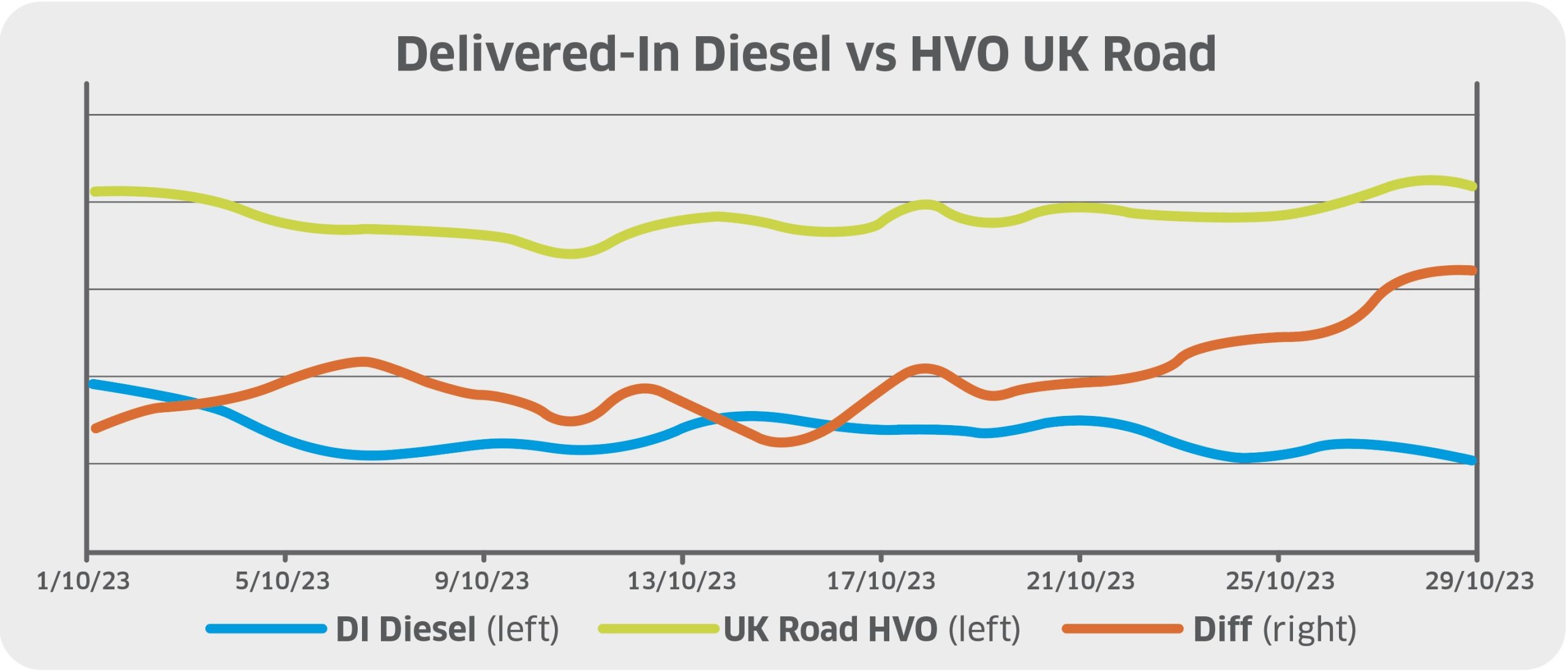

As traditional diesel pricing generally follows a similar trajectory to its underlying benchmark Brent crude, commercial bulk diesel prices also declined significantly in the first week from 129ppl to 121ppl, as shown by Portland Pricing’s index.

However, concerns of further supply disruptions due to a turbulent geopolitical landscape supported oil prices, as Hamas militants coordinated a surprise offensive on Israel on the 7 October, marking the beginning of the Israel-Hamas war.

The International Energy Agency claimed that the conflict had not yet had a direct impact on oil supplies. However, the oil market would undoubtedly face repercussions if the conflict widened.

Western leaders, including US President Joe Biden and UK Prime Minister Rishi Sunak, stepped up their diplomatic efforts as a humanitarian crisis unfolded, attempting to prevent the Middle East turmoil from spreading across the region. These attempts helped prevent oil prices from surging, alongside China’s economic recovery facing another hurdle with an unexpected decline in manufacturing activity, despite recent indications of the nation’s economy stabilising.

In the UK, the unemployment rate rose and the economy continued to contract in October following a decline in services and manufacturing output, dampening the demand outlook. The Bank of England’s Deputy Governor, Ben Broadbent, warned of “clear signs” that interest rates are adversely impacting the economy and employment levels, leading to expectations that the central bank will continue holding interest rates.

Conversely, the US Federal Reserve is expected to raise interest rates again in 2023, resulting in a widening interest rate gap between the US and UK. After its worst monthly performance against the US dollar in over a year in September, sterling remained at around US$1.21 throughout October, therefore failing to contribute to the fall in UK diesel pricing.

The cost to blend biodiesel to the UK standard of 7% biodiesel (B7 specification) declined marginally by c.1ppl across October to trade at c.2ppl, its lowest price since May, partly contributing to the fall in commercial bulk diesel prices. Overall, despite regaining some losses by mid-month, commercial bulk diesel declined again and closed October at 121ppl.

In comparison, the price of renewable diesel (HVO) increased marginally from 151ppl to 152ppl per litre across October. However, as diesel prices fell significantly, alongside Renewable Transport Fuel Certificates (RTFCs) falling to 15ppl, halving since the beginning of the year and decreasing the benefit that HVO consumers receive, the differential between the premium of renewable diesel and traditional fossil diesel widened from 22ppl to 31ppl by month-end.

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information visit its website.