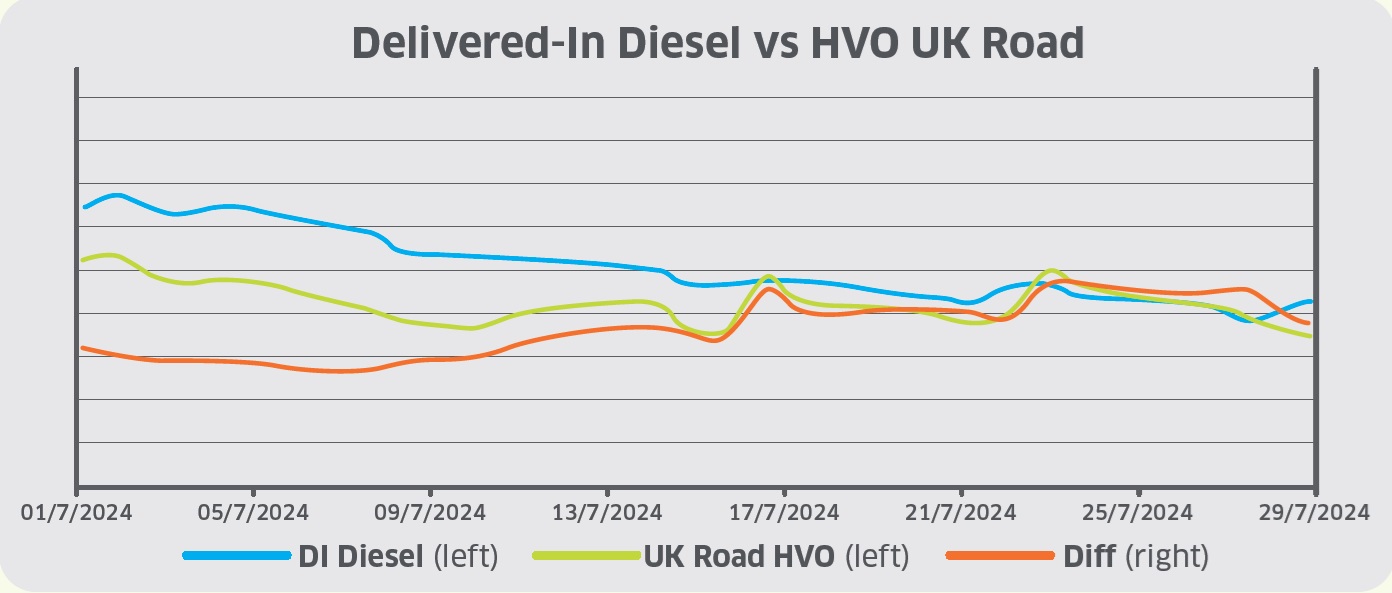

Broadly following the trend in crude markets, Portland Pricing’s UK delivered-in diesel price fell throughout July. After beginning the month at c.114ppl, increasing hopes of a ceasefire in Gaza and weak demand indicators weighed on prices, which finished July at c.109ppl, a level not seen since early June.

Easing concerns over potential supply disruptions began the slide, after Hurricane Beryl had minimal impact on production in the United States Gulf Coast region. Furthermore, production in the Canadian oil sands region was found to have been mostly unaffected despite the threat of wildfires, according to Goldman Sachs.

Sentiment over risk in the Middle East decreased for much of July on progressing ceasefire talks, with US Secretary of State Antony Blinken describing a deal as “close to the goal line” towards the end of the month. That optimism was dashed after Hamas’s political leader, Ismail Haniyeh, was killed in an Israeli airstrike in Tehran, risking confrontation with Iran and adding to ongoing fighting with Hezbollah on Israel’s northern border.

On the demand side, data from China gave renewed cause for concern, revealing that its total fuel oil imports dropped by 11% in H1 2024 compared to the same period in 2023. This was highlighted by an unexpected interest rate cut towards the end of the month in response to disappointing GDP figures, intended to stimulate growth.

Sterling performed strongly throughout the first half of July after starting at US$1.264. The upward trend was supported by US inflation data, which cooled to its slowest pace since 2021 – sending a strong signal that the Federal Reserve will begin cutting interest rates soon. Labour’s landslide election victory was also received positively by markets, pushing sterling up to a high of US$1.301 mid-month.

After breaking US$1.30 for the first time since July 2023, the pound was pressured by the strongest manufacturing data since February 2022, supporting the case for a rate cut. JP Morgan correctly predicted a 5-4 vote in favour of a reduction, pressuring sterling to finish July at US$1.284 as Bank of England and Federal Reserve policies diverged.

The cost to blend biodiesel to UK B7 specification decreased slightly, from 5.5ppl to 5.0ppl. The wholesale cost of FAME-10 fell further than the price of fossil diesel, reducing the cost of RTFO compliance.

Finally, UK renewable diesel (HVO) prices fell from c.111ppl to c.108ppl in July. The price of Renewable Transport Fuel Certificates (RTFCs) rose to 20.5ppl, increasing the benefit that HVO consumers receive (assuming 100% of the RTFC benefit is passed onto the end-user).

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information, visit its website.