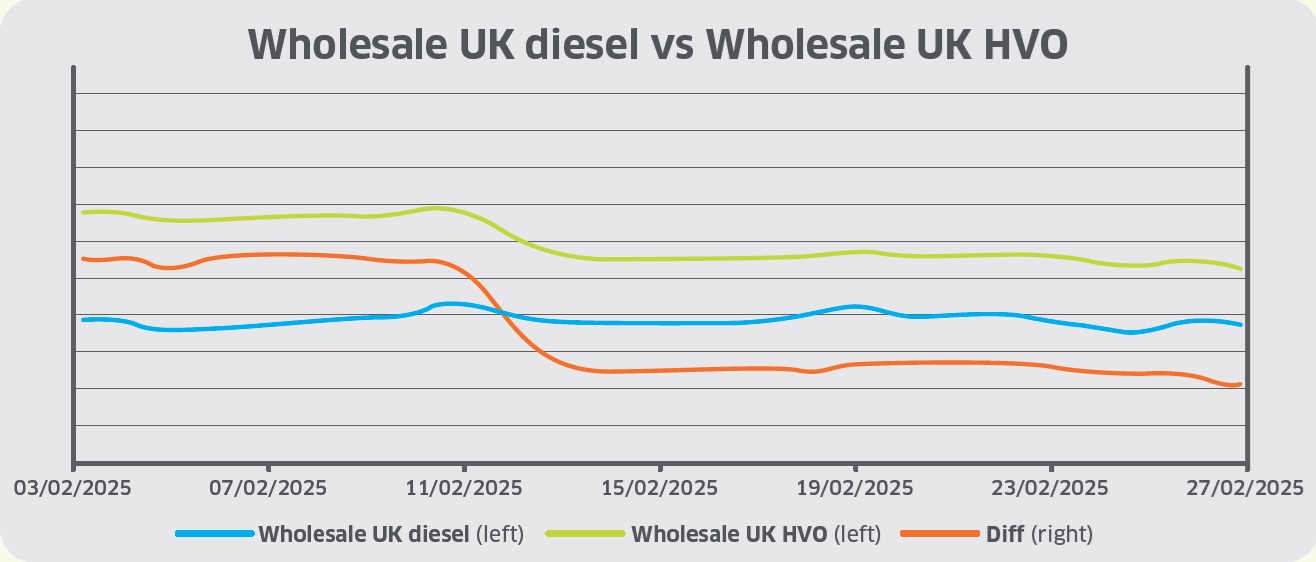

Wholesale UK diesel prices declined from 56ppl (excluding duty) to 55ppl during February. During the first half of the month, diesel remained steady, increasing marginally to 57ppl following a rally in natural gas prices to their highest levels in two years, prompting substitution to diesel as a source of European power generation.

Subsequently, wholesale UK diesel prices declined broadly in line with the underlying Brent crude benchmark towards the end of the month due to easing supply-side risk premiums on renewed optimism surrounding a peace deal between Russia and Ukraine.

Sterling traded at US$1.241 at the beginning of February and experienced an uptrend throughout the month after United States President Donald Trump delayed the implementation of 25% tariffs on imports from Canada and Mexico.

By mid-month, sterling appreciated to the highest levels in two months after UK gross domestic product data revealed that the economy grew by 0.1% during the final quarter of 2024, exceeding market projections of a 0.1% contraction.

By the end of the month, sterling traded at US$1.259 as the US dollar price index declined to two-month lows, triggered by rising uncertainty within US markets about the prospects of the economy. As a result of sterling’s appreciation against the dollar throughout the month, UK diesel became marginally cheaper by 0.7ppl as diesel is traded in USD.

Wholesale UK renewable diesel (HVO) prices fell from 118ppl to 105ppl (excluding duty and Renewable Transport Fuel Certificate (RTFC) benefit) during February, the lowest level in four months.

During the first half of February, HVO traded in a narrow range between 117ppl and 118ppl due to bullish sentiment across Southeast Asian markets after Italy announced a delay in its exclusion of palm oil feedstocks from its biofuel blend mandate until 2026.

In the freight industry, reports revealed that Neste and DHL have partnered to study the adoption of Neste’s HVO and Sustainable Aviation Fuel into DHL’s road and air operations, with the potential to adopt approximately 300,000 metric tonnes of them annually by 2030.

By the end of the month, HVO prices declined to 105ppl, the lowest level since October 2024, following reports of an influx of cheaper used cooking oil (UCO) feedstock imports from Asian markets, a crucial feedstock used in the production of HVO.

As a result, the European biofuel industry has become increasingly concerned over the high quantities of Chinese UCO feedstocks entering European markets, pressuring European feedstock production margins.

In other news, Barclays analysts projected that the US HVO market will remain oversupplied until 2030. However, demand may then surpass supply due to major oil suppliers withdrawing from renewable fuel projects.

Furthermore, GB Railfreight announced its adoption of HVO on the route between the Port of Liverpool and Drax power station for 12 months. According to the railfreight operator, its transition to HVO is part of a broader carbon reduction plan, particularly in cases when electrification is unfeasible, as HVO is a direct replacement for diesel, not requiring any engine modifications.

At the end of the month, official data revealed that German biofuel demand declined to a five-year low of 207,469 metric tonnes in November 2024, due to the rollover of surplus emission tickets in 2024 from the year prior, weighing down on blending requirements.

As a result, the HVO blend rate hit a record low of 3.9% in November 2024, compared to 7.4% in the same period in the previous year.

The cost of blending biodiesel to the UK B7 specification rose from 6.2ppl to 6.9ppl throughout February. The cost of Renewable Transport Fuel Obligation (RTFO) compliance became dearer as wholesale FAME-10 prices rose by 6% throughout the month.

Furthermore, the price of RTFCs fell marginally from 26p to 25p per certificate, thus reducing the benefit for HVO consumers (assuming 100% of the RTFC benefit is passed on the end-user).