UK delivered-in diesel dropped to c.109ppl at the beginning of June before rising towards month end according to Portland Pricing’s national average, with the former being at a level not seen since July 2023.

Despite extending production cuts at their June meeting, OPEC+ members indicated a direction to reintroduce barrels into the market in Q4 2024, pressuring prices on concerns of a surplus of supply. Throughout the rest of the month, the diesel price followed a broader rebound in oil markets, finishing at c.114ppl.

After OPEC+ clarified that it would relax cuts only if market conditions allow, renewed demand growth optimism supported the upward trend. The US Energy Information Administration (USEIA) revised its oil demand growth outlook upwards ahead of the US summer driving season, and OPEC+ maintained its bullish 2.2 million barrels per day prediction.

Heightened geopolitical instability also priced risk into energy markets, with a renewed focus on both Ukraine and the Middle East. Iran-backed Hezbollah militants increased the intensity of attacks on Israel Defense Forces troops, and Israeli Prime Minister Benjamin Netanyahu vowed to commit personnel to the Lebanon border as the Rafah offensive nears completion, potentially reigniting tensions with Iran.

Although supply from the Middle East has broadly been unaffected by the Israel-Hamas war, attacks by Houthi rebels on ships in the Red Sea continued. USEIA data revealed that the quantity of crude oil and refined products transported via Africa’s Cape of Good Hope surged by 50% between January and May, increasing supply costs.

Despite reaching a three-month high of US$1.284 by mid-June, the pound trended downwards against USD during the month. Weak US Personal Consumption Expenditures and labour market data indicated that the Federal Reserve may have to move faster in cutting rates.

However, after voting to leave them unchanged in the June meeting, Chair Jerome Powell indicated that it expects rate cuts to be pushed back as far as December, pending evidence that inflation is dropping to its 2% target.

Despite the Bank of England (BoE) voting to maintain rates at its June meeting, the decision was described as “finely balanced” for many BoE policymakers, offering the dollar support. Additionally, UK inflation fell to 2% in May, in line with the BoE target, with all but two of 65 economists polled by Reuters predicting an August reduction.

These factors pressured GBP, which finished the month at US$1.264 – equivalent to an increase of almost 1ppl in diesel prices from its intra-month high.

The cost to blend biodiesel to the UK B7 specification decreased slightly, from 6.5ppl to 5.5ppl. The wholesale cost of FAME-10 trended sideways, whereas the increase in the cost of fossil diesel narrowed the differential, increasing the cost of Renewable Transport Fuel Obligation compliance.

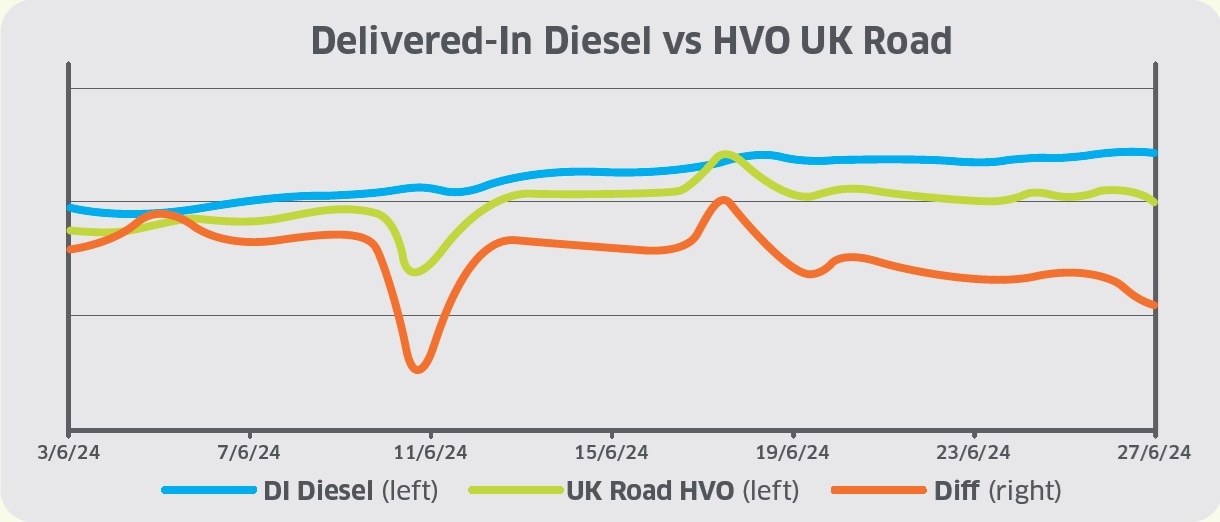

Finally, UK renewable diesel (HVO) price rose from c.108ppl to c.111ppl in June. The wholesale cost of HVO drove this change, with the price of Renewable Transport Fuel Certificates (RTFCs) unchanged at 20ppl. That resulted in HVO consumers receiving the same benefit as the previous month (assuming that 100% of the RTFC benefit is passed onto the end-user).

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information visit its website.