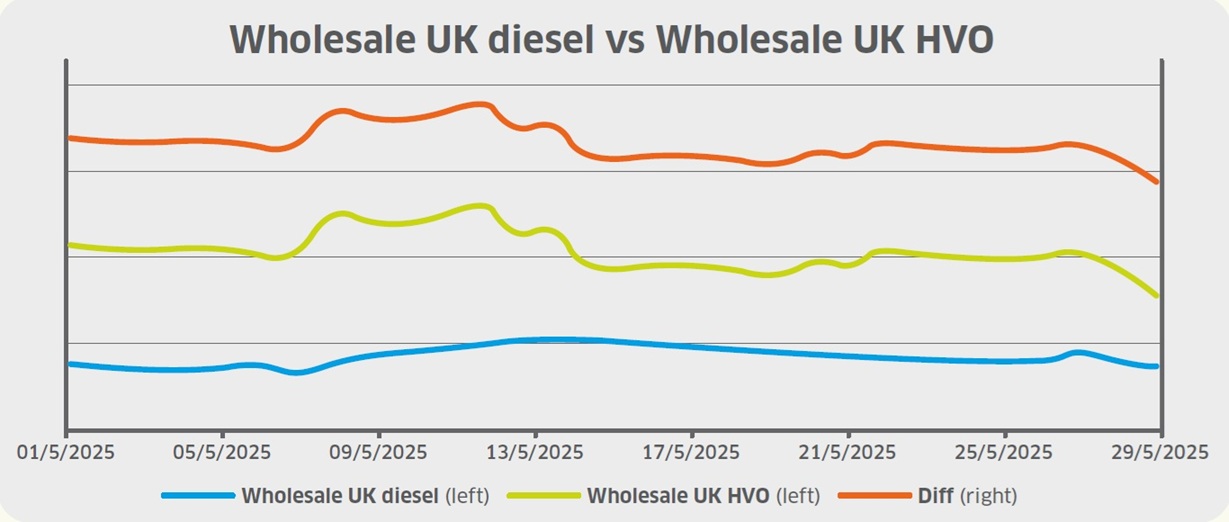

Wholesale UK diesel prices remained virtually unchanged across May at just below 46ppl excluding duty despite rising mid-month, broadly aligning with the underlying Brent crude benchmark.

President Trump’s tariffs continued to cause trade uncertainty. Both the US and China reported weak economic data, dampening demand sentiment. On the supply side, OPEC+ was set to hike production by 411,000 barrels per day in July, exacerbating global oversupply concerns.

Towards the end of May, a legal back-and-forth between President Trump and US courts over tariffs added significant volatility to the market. That came after the US Court of International Trade blocked President Trump from imposing sweeping global tariffs, stating that he had exceeded his authority.

However, the Trump administration appealed the decision and the US Federal appeals court temporarily reinstated tariffs a day later, causing oil prices to fall again by month-end.

GBP strengthened from just below US$1.330 to US$1.349 throughout May, reaching its highest level since February 2022 as a weak US dollar supported the pound.

Data revealed that the US economy contracted by 0.3% in Q1, marking the first negative reading since 2022. The US Federal Reserve held interest rates in a range between 4.25% to 4.5%, unchanged since December 2024 despite pressure from President Trump to cut rates amid high tariff uncertainty and rising economic risks.

In contrast, the Bank of England opted to cut its key interest rate by 25 basis points, although the vote split was more hawkish than expected with two members voting to hold interest rates, supporting the pound.

Additionally, recent data revealed that the UK Consumer Prices Index rose by 1.2% month-on-month and 3.5% year-on-year in April. Food inflation rose to 4.1%, decreasing the likelihood of interest rate cuts.

GBP closed around 1.5% higher than the beginning of the month, leading to a c. 0.56ppl reduction in UK wholesale diesel.

Wholesale UK renewable diesel (HVO) prices fell from 111ppl to sub-108ppl throughout May (excluding duty and RTFC benefit) as weaker waste feedstock costs, namely used cooking oil (UCO), lowered prices.

Falling feedstock prices have reflected recent expectations of increased UCO supply from China into Europe, driven primarily by changing US biofuel and trade policies.

For instance, the Trump administration initiated a 125% tariff on Chinese UCO imports in April, leading to a sharp decline in shipments. In Europe, investors anticipate that increased supply will continue to pressure regional UCO prices.

Furthermore, a cargo of renewable diesel departed from Jiangsu province in China to Europe towards the end of May according to port authorities despite the EU’s anti-dumping duties on Chinese renewable diesel and biodiesel.

The EU launched its anti-dumping investigation in December 2023, following a complaint from the industry association European Biodiesel Board that an increasing number of waste-based products from China had caused production slowdowns and stoppages in Europe.

The duties, announced in February this year, included tariffs set at 35.6% as a baseline. However, a Singapore-based trader indicated that there could still be interest in Chinese HVO if producers lower their prices enough for buyers in the EU to maintain margins.

The cost of blending biodiesel to the UK B7 specification decreased marginally to 7.4ppl in May. The cost of Renewable Transport Fuel Obligation compliance therefore fell slightly.

Additionally, the price of Renewable Transport Fuel Certificates (RTFCs) also declined fractionally from 26.5p per certificate (ppc) to 25.7ppc, thus slightly reducing the benefit that HVO consumers received compared to the previous month (assuming 100% of the RTFC benefit is passed on the end-user).