In April, wholesale UK diesel prices declined from 53ppl to 47 ppl (excluding duty), broadly aligning with the underlying Brent crude benchmark. The potential impact of President Trump’s tariffs continued to cause supply concerns, alongside OPEC+ announcing an unexpected increase in crude oil production in May.

On the demand side, the ongoing US-China trade war exacerbated global demand concerns. Uncertainty over whether formal negotiations were taking place between the two countries dampened market sentiment further, and OPEC and the International Energy Agency both cut 2025 demand forecasts.

Towards month-end, Kazakhstan stated it will prioritise national interests over OPEC output quotas, signalling higher production levels and causing oil prices to slide further.

GBP appreciated throughout April against USD from US$1.294 to US$1.336, near its highest level since February 2022, largely due to a weak dollar. Persistent uncertainty over trade policy and the US-China trade war continued to reduce confidence in the US economy.

Although President Trump’s tariffs sparked concerns about the impact on the UK economy, the US delayed tariffs by 90 days for all countries except China, bringing relief.

The US Dollar Index weakened to its lowest level in three years, following escalated tensions between President Trump and the US Federal Reserve, with the President criticising the central bank for its lack of interest rate cuts.

Despite a weak economy, the International Monetary Fund projected that the US would avoid a recession this year. GBP’s rally throughout April, recording its strongest monthly performance against USD since November 2023, leading to a reduction in UK wholesale diesel by 1.31ppl.

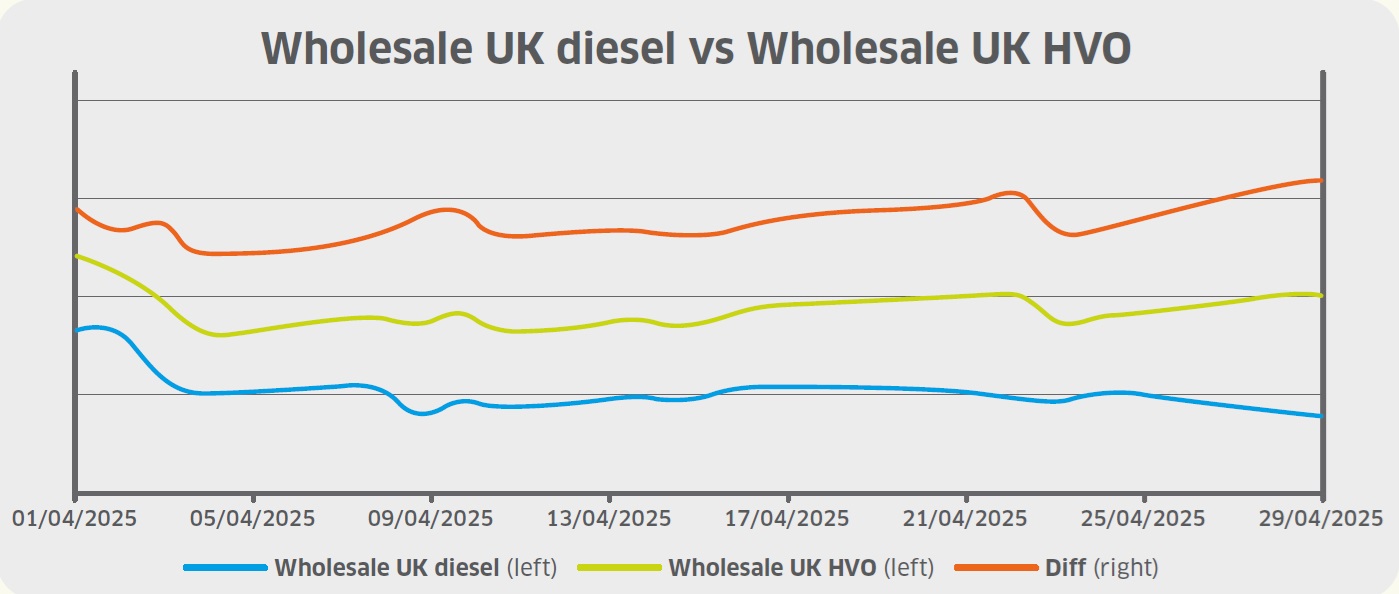

Wholesale UK renewable diesel (HVO) prices declined from 115ppl to below 111ppl (excluding. duty and RTFC benefit) throughout April amid falling feedstock prices, namely used cooking oil (UCO), alongside increased supply into the European market.

The Trump administration is now charging a 125% import tariff on Chinese UCO, effectively closing off a market that accounted for US$1.1 billion in shipments in 2024. According to China-based UCO traders, the last cargoes to the US left ports in late March and early April before trade activity largely ceased.

Despite the EU enforcing its own measures on Chinese UCO, US tariffs are expected to redirect the surplus volume to Europe, increasing supply and easing prices. Additionally, supply is also expected to increase in emerging Asian markets, including South Korea, Thailand, Malaysia, and India.

The HVO supply landscape also faces challenges due to potential fraud in the feedstock supply chain.

The Department for Transport launched an investigation into HVO production in April, after BBC research and whistleblower testimonies highlighted specific issues concerning the use of virgin palm oil in production, fraudulently relabelled as waste products from palm oil, such as palm oil mill effluent (POME).

Data compiled by Transport & Environment shows that the UK and EU used around two million tonnes of palm sludge waste for HVO and other biofuels in 2023, double the reported amount of global production of one million tonnes.

As a result, the EU is considering suspending automatic acceptance of International Sustainability and Carbon Certification Proof of Sustainability (PoS) certificates, following complaints that the organisation has not been sufficiently addressing fraudulent activity within supply chains.

Without guaranteed acceptance of PoS certificates by government authorities, suppliers of biofuels would face significant risk because auditing supply chains directly is typically unfeasible due to commercial sensitivities, limited resources, and time constraints.

The cost of blending biodiesel to UK B7 specification rose marginally from 7.2ppl to 7.5ppl throughout April. The cost of Renewable Transport Fuel Obligation compliance became dearer, as although the cost of FAME-10 declined slightly, wholesale diesel fell at a more significant rate, widening the differential.

Additionally, the price of Renewable Transport Fuel Certificates (RTFCs) remained at the same 26.5p. HVO consumers therefore received the same benefit as the previous month – assuming 100% of the RTFC benefit is passed on the end-user.