Brent crude futures eased from October’s highs during November after geopolitical premiums were offset by concerns of decelerating demand and potential oversupply.

Opening at US$73.10 per barrel at the beginning of November, movements fluctuated between US$75.10 and US$70.80 before settling at $72.94 by month end. According to Portland Pricing’s national average price, delivered-in diesel increased marginally from 106ppl to 107ppl.

Investors increasingly adopted a bearish stance on Brent crude futures throughout November amid heightening economic uncertainty in China, lowering the price floor to a two-month low at US$71.04 per barrel by mid-month.

Deflationary pressures persisted across China’s economy as CPI rose by 0.3% in October compared to 2023 levels, failing to meet market expectations. Concerns of decelerating demand worsened as Chinese customs data revealed a 9% decline in crude imports during October against 2023, underscoring the ineffectiveness of recent fiscal measures in fuelling growth for the world’s largest crude importer.

Supply-side factors further catalysed downside pressures on crude prices as concerns of potential oversupply mounted after the International Energy Agency projected a 1.15 million barrels per day supply surplus in 2025 due to non-OPEC supply growth. As a result, reports suggested that OPEC may again delay its planned output hikes in its December meeting.

Geopolitical risk premiums priced into crude stemmed majorly from the worsening hostilities between Russia and Ukraine.

Ukraine’s employment of Western-produced artillery, as well as Russia’s revision of its nuclear doctrine that expanded the conditions under which nuclear weapons can be used, sparked fears of further escalating tensions.

In the Middle East, the United States-mediated ceasefire between Israel and Hezbollah subsided geopolitical premiums on Brent futures, although traders remained cautious following reports of ceasefire violations.

GBP depreciated against USD throughout November, opening at US$1.295 and falling to US$1.271 against by month-end, resulting in a 1ppl rise in the cost of diesel for UK consumers based on the current wholesale diesel prices.

Donald Trump’s victory in the US presidential election boosted investor confidence in the prospects of the US economy, causing the dollar price index to rise. By the latter half of the month, GBP declined to a six-month low of US$1.25 after UK GDP revealed 0.1% growth in the third quarter, falling short of market projections.

GBP regained some ground by month-end towards US$1.27 as investors became cautious of Trump’s plans to impose tariffs on Canada, Mexico and China.

The cost of blending biodiesel to UK B7 specification was largely unaltered during November at just under 7ppl as FAME-10 traded sideways. Therefore, the cost of Renewable Transport Fuel Obligation compliance remained the same at the end of the month.

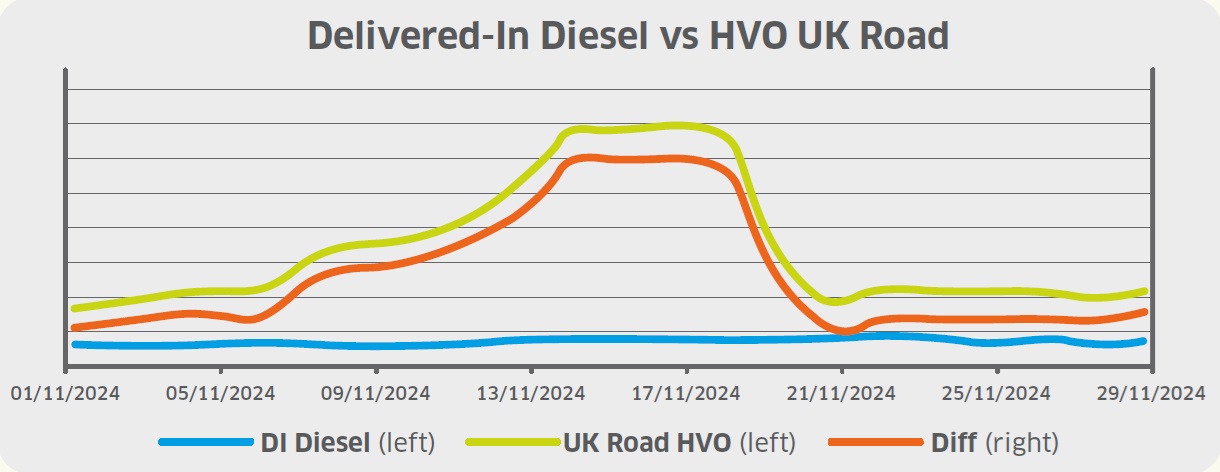

Wholesale UK renewable diesel (HVO) prices increased from 117ppl to 121ppl across November, although they faced extreme volatility during the month. HVO shipments were temporarily halted following a fire at Neste’s biofuel refinery in Rotterdam, causing a soar to 169ppl mid-month. However, prices eased after production resumed.

Renewable Transport Fuel Certificates (RTFCs) remained unchanged at 23p per certificate, maintaining the same benefit for HVO consumers (assuming 100% of the RTFC benefit is passed on the end-user). HVO prices rose more than delivered-in diesel prices, thus expanding the differential.

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information, visit its website.