Brent crude experienced high levels of volatility throughout October, hitting highs of US$80.90 per barrel and lows of US$71.12. However, by month-end prices settled at US$73.13, not far from the opening price of US$73.56. According to Portland’s national average price, delivered-in diesel increased marginally from 104ppl to 106ppl.

Downward price pressures on Brent crude were attributed to weakening demand concerns in China, as trade statistics revealed that Chinese crude imports fell by 7.4% from the previous month amid weaker refining activity.

The annual World Energy Outlook report released by the International Energy Agency revealed that China is expected to dominate global demand growth for electric vehicles (EVs), with over 1.1 million EVs sold in the previous month.

On the supply side, Libya resumed oil production after a two-month shutdown, recovering 1.3 million barrels per day (BPD) by mid-October. However, an OPEC+ meeting established production cut targets of 2.2 million BPD beginning in November in a bid to retain competitive prices.

The US Energy Information Administration revealed that oil trade flows through the Bab El-Mandeb strait fell by over half during the first eight months of 2024 due to Houthi attacks on vessels.

Consequently, vessels opted for the longer route around South Africa to reach Europe which has led to an estimated additional fuel cost of up to US$1 million for voyages between the Far East and Northern Europe.

Geopolitical risk premiums became increasingly prominent throughout October following Iran’s missile assault on Israel at the onset of the month. Investors feared a potential retaliatory attack on Iran’s oil infrastructure, which may have potentially disrupted oil trade flows through the Straits of Hormuz, transited by 30 per cent of global oil trade.

Escalating turmoil in the Middle East was further reiterated by Israel’s incursion into Lebanon with the aim of suppressing the Lebanese militant group, Hezbollah. However, risk premiums were alleviated by month-end following Israel’s retaliatory attack that spared Iranian oil infrastructure.

Sterling faced a downward trajectory throughout October, entering the month at US$1.328 and dropping below US$1.290 by month-end, leading to a 1ppl increase in the cost of diesel for UK consumers.

Earlier in the month, the Governor of the Bank of England signalled towards an activist approach in cutting interest rates, causing sterling to depreciate against the US dollar due to diminishing investor confidence.

Though sterling recouped some losses throughout the month following the release of positive economic indicators, gains were quashed by the hike in bond yields on UK gilts following the autumn budget announcement.

In the US, economic indicators signalled a growing economy and cooling inflation. CPI data revealed that inflation fell by 0.1% to 2.4%, whilst retail sales data rose by 0.4%, which improved the outlook of a hawkish stance by the Federal Reserve, favoured by the markets.

The cost to blend biodiesel to the UK B7 specification increased from 5ppl to 7ppl during October. The cost of renewable transport fuel obligation compliance became dearer as FAME-10 prices increased by 13.62% by the end of the month, whilst the raw cost of diesel declined by 0.95%.

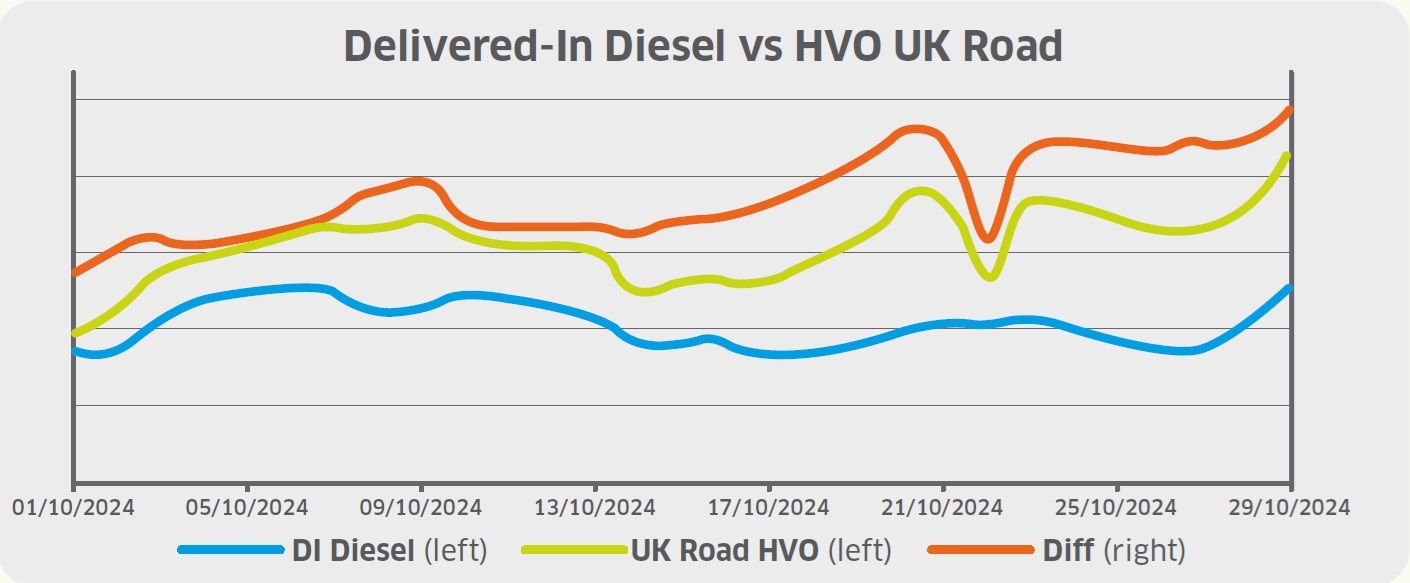

Wholesale UK renewable diesel (HVO) prices increased from c.105ppl to 115ppl throughout October due to hikes in renewable diesel premiums. The price of renewable transport fuel certificates (RTFCs) rose by c.2p to 23p per certificate, increasing the benefit for HVO consumers (assuming 100% of the RTFC benefit is passed onto the end-user).

Additionally, HVO prices increased more than the price of delivered-in diesel, revealing an expanding differential.

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information visit its website.