Although heightened tensions in the Middle East caused significant volatility and supply-side risk, Brent crude prices declined by almost US$6 per barrel across September, briefly touching the lowest level since December 2021 at c.US$69.

According to Portland Pricing’s national average price, delivered-in diesel also fell from c.106ppl to c.103ppl, approaching 102ppl, a level unseen since August 2021.

The falling market was underpinned by a weak demand sentiment, driven by leading oil importer China. Its oil consumption is set to expand by just 180,000 barrels per day (BPD) in 2024, due to a slowing economy and an increasing switch to alternative fuels.

OPEC reduced its global oil demand growth forecast for 2024, and the International Energy Agency also suggested that demand has continued to decelerate, with H1 2024 gains of 800,000 BPD year-on-year, the lowest since 2020.

Alongside major demand concerns, the prospect of rising supply contributed to lower prices, after OPEC planned to increase production by 180,000 BPD in Q4. However, the group later decided to postpone the increase to December, helping prices to recover slightly.

Additionally, Hurricane Francine significantly disrupted oil supply on the US Gulf Coast, impacting an estimated 42% of crude production, equal to 1.5 million BPD. Although refining activities gradually resumed, an estimated 12% of crude production was still offline by 16 September.

A fragile geopolitical landscape provided some support to prices, as Middle East tensions showed no signs of halting despite relentless calls from the west for an immediate ceasefire. Towards the end of September, Israel concealed explosives inside batteries of pagers and walkie-talkies sold to Hezbollah, leading to thousands of explosions in Beirut and other areas of the country.

Additionally, Israeli strikes on Lebanon saw the deadliest attack since the 2006 Israel-Hezbollah war, killing Hezbollah’s leader. The two nations continue to retaliate, intensifying the risk of a broader regional conflict.

Meanwhile, Russian President Vladimir Putin exacerbated geopolitical concerns, after warning the west that Russia could use nuclear weapons if struck with conventional missiles, proposing a new nuclear doctrine that would enable them to do so.

In the UK, GBP recorded another strong performance in September, closing at its highest since February 2022 at just below US$1.34. The pound appreciated due to diverging monetary policies between the UK and US.

The Bank of England opted to maintain the 5% interest rate following resilience in the employment market, whereas the US Federal Reserve cut interest rates by 50 basis points. A stronger British pound contributed to a marginally lower diesel cost for the UK consumer of around 1ppl.

The cost to blend biodiesel to the UK standard B7 specification hovered just under 6ppl throughout September, remaining at the same level to the previous month. The cost of RTFO compliance thus remained the same.

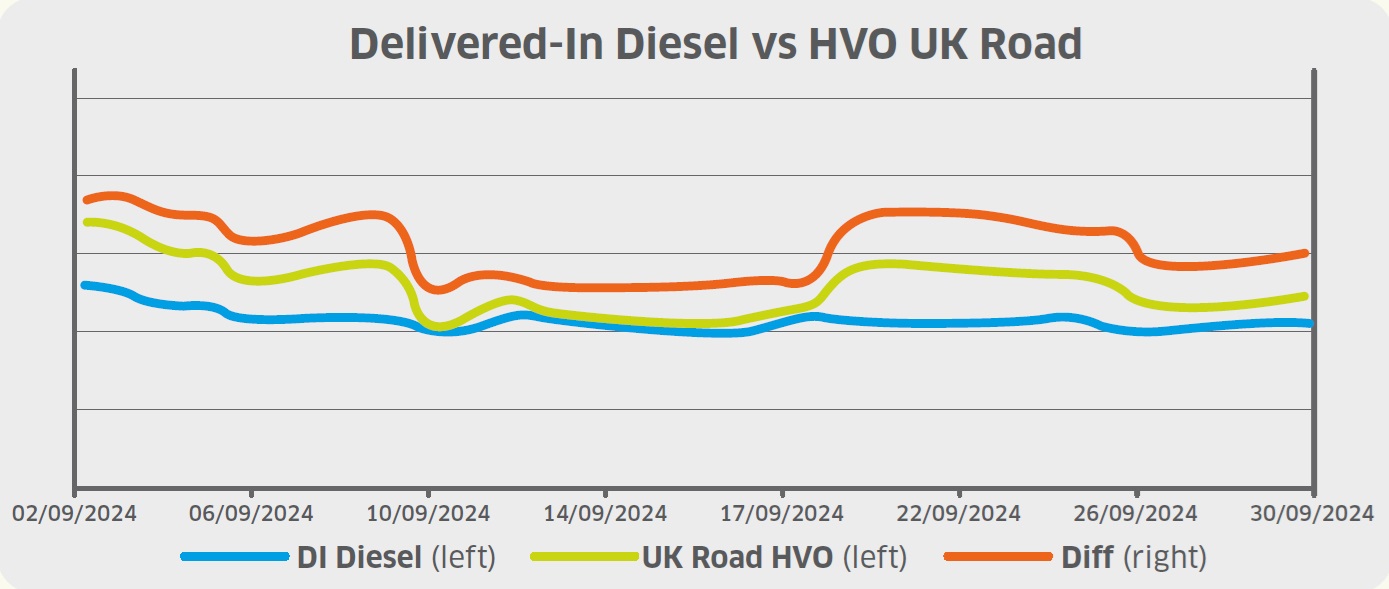

Finally, wholesale UK renewable diesel (HVO) prices declined from c.111ppl to c.105ppl across September. The price of Renewable Transport Fuel Certificates (RTFCs) rose by around 2p to 21p per certificate, increasing the benefit that HVO consumers receive (assuming 100% of the RTFC benefit is passed onto the end-user).

As the wholesale UK renewable diesel price (excluding any additional premiums) declined more than the delivered-in diesel price across September, the differential between the two narrowed.

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information, visit its website.