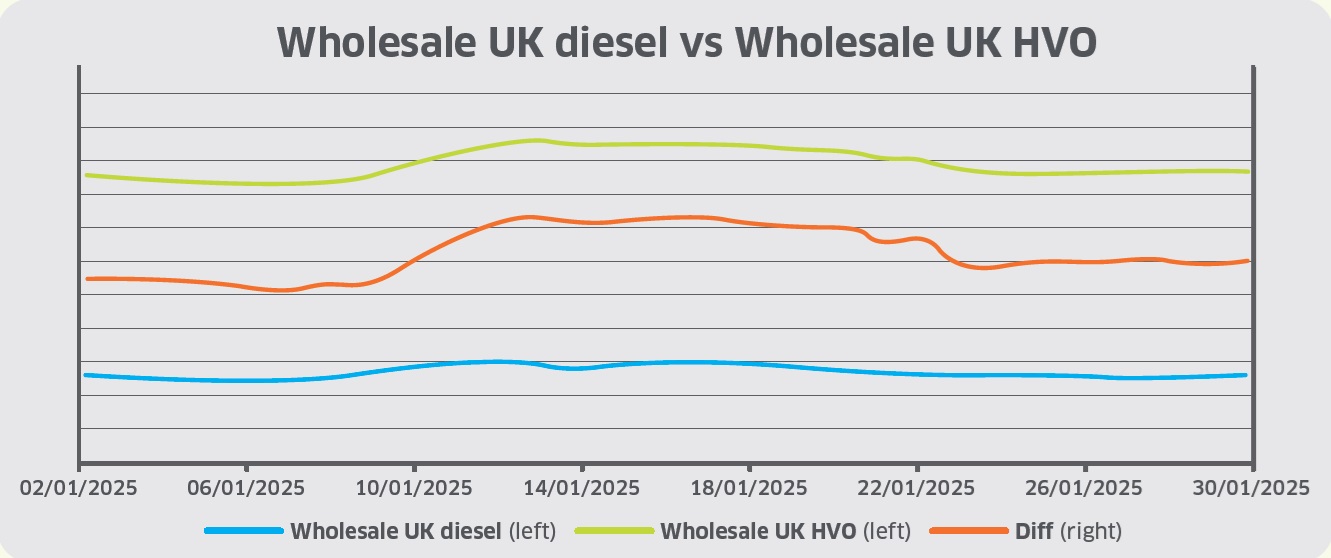

Wholesale UK diesel traded at 56ppl excluding duty at the beginning of January and settled marginally lower at 55ppl by close. By mid-month, it surged to 60ppl amid rising global supply-side risks after the Biden administration imposed sanctions on the Russian oil industry.

In the latter half of January, diesel declined as markets weighed the return of European shipping through the Red Sea amid easing geopolitical tensions, lowering freight costs and increasing supply to the UK market.

At the end of the month, wholesale UK diesel prices eased as provisional government data revealed that diesel and gasoil production in the UK rose by 23% in November 2024 compared to the same period in the previous year amid rebounding margins.

At the beginning of January, GBP traded at US$1.234, beginning its downtrend after UK Gilt yields soared to multi-decade highs. 10-year yields were at 4.90% and 30-year yields at 5.40% due to growing concerns surrounding the UK fiscal outlook.

GBP fell to a fourteen-month low of US$1.215 after Donald Trump’s inauguration as United States president, with investors anticipating a series of tariffs on US imports and potential trade wars as a consequence.

By the end of the month, GBP recouped losses to US$1.243 as investors awaited the upcoming Bank of England interest rate decision to gain an indication of the direction of the UK economy.

Wholesale UK renewable diesel (HVO) traded at 116ppl (excluding duty and Renewable Transport Fuel Certificate (RTFC) benefit) at the beginning of January, and ended the month marginally higher at 117ppl.

However, during mid-month, HVO traded at 126ppl due to firmer feedstock prices, particularly for used cooking oil and tallow, as Neste resumed operations at its Rotterdam biorefinery after a fire caused an emergency closure in November.

As a result, reports suggested that an additional 200,000 metric tonnes of renewable fuels could potentially enter the market as Neste aims to fulfil deliveries that were missed in Q4 2024, thus pressuring feedstock supplies.

However, HVO prices eased by the end of the month following reports of high availability for Q1 deliveries as Eni, Neste and US producers have ample supply.

Furthermore, equity firm Quinbrook Infrastructure partners has provided £100 million in funding to Aegis Energy to develop and construct five green fuelling stations in the UK, offering renewable diesel to operators. The first opening is estimated to be in early 2026, with the network to be completed by the end of 2027.

In other news, Neste and KPI Ocean Connect have collaborated on the supply of HVO to the marine sector in Singapore, marking a significant milestone for the biofuel industry. As one of the largest global trading hubs, Singapore aims to reduce greenhouse gas emissions by at least 60% by 2030 compared to 2005 levels.

Furthermore, data revealed that a record number of US federal renewable fuel certificates were generated in 2024 due to a rise in HVO usage. As a result of rising global demand for renewable fuel feedstocks, prices of used cooking oil feedstocks in China are set to rise.

The cost of blending biodiesel to UK B7 specification declined marginally from 6.5ppl to 6.3ppl during January. The cost of Renewable Transport Fuel Obligation (RTFO) compliance therefore became cheaper as wholesale FAME-10 prices fell by 1.9% throughout the month.

Additionally, the price of RTFCs rose from 24p to 26p per certificate, therefore increasing the benefit for HVO consumers (assuming that 100% of the RTFC benefit is passed on the end-user).