In the first month of 2024, concerns of oil supply disruptions were driven by escalating Middle East tensions. Meanwhile, an improving demand outlook was evident, causing oil prices to climb steadily throughout January.

The turbulent geopolitical landscape persisted, as Houthi militants continued to attack commercial vessels linked with Israel in the Red Sea, in addition to US and UK military warships. In response, the US and UK launched retaliatory airstrikes, and despite acknowledging that strikes had been ineffective at halting Houthi attacks, US President Joe Biden vowed to continue.

US Secretary of State Anthony Blinken also visited the region for a week of diplomacy, to rally support for humanitarian relief in Gaza, urge leaders to prevent escalating conflict, and to warn that Houthi aggression against global Red Sea shipping would be met with severe consequences.

The Ukraine-Russia war also continued to impact the oil market, following reports of multiple Ukrainian drone strikes on an oil refinery on the Black Sea coast, an oil product depot in Bryansk, and the St. Petersburg Oil Terminal.

Further supply disruptions were caused by protests in Libya, which forced the shutdown of the 300,000 barrel per day (BPD) Sharara oil field. Additionally, the chief of Saudi state-owned Aramco warned of possible global supply shortages, anticipating a surge in Chinese demand.

However, some positive supply news was announced in January, as Nigeria’s 650,000 BPD Dangote oil refinery begun producing diesel and aviation fuel after years of construction delays, and is expected to end the nation’s dependency on imported refined petroleum products.

Moreover, the demand sentiment improved after top oil importer China announced that stimulus measures would be introduced in February to boost the economy, following evidence of contracting manufacturing activity and a weak property sector.

Data revealed that India’s fuel demand reached a seven-month high, and US crude inventories hit their lowest levels since October, according to the Energy Information Administration. Global oil demand growth projections saw OPEC forecasting an ambitious 2.25 million BPD for 2024, whereas the International Energy Agency forecasted a more moderate growth of 1.24 million BPD.

The improving global economic outlook also strengthened demand, as the International Monetary Fund reported a decline in global inflation, resilience in the US and fiscal support in China.

In the UK, a labour market slowdown was evident, UK retail sales declined to the lowest reading since lockdowns, and manufacturing PMI data contracted for the 17th consecutive month in December 2023.

Inflation unexpectedly rose for the first time in ten months to 4% in December, leading to the Bank of England holding interest rates at a 16-year high of 5.25%. However, Governor Andrew Bailey insisted that the UK economy remains resilient to high interest rates. Likewise, the US Federal Reserve held interest rates at a 23-year high, and although a strong US dollar limited gains, GBP appreciated from $1.263 to $1.273 against USD, contributing fractionally to a lower UK diesel price.

As a result of supply concerns and an improved demand outlook, Brent crude rose from US$76 per barrel to just below US$82 per barrel by month-end. Portland Pricing’s index highlighted that delivered-in diesel increased from 112ppl to 117ppl, following a similar trajectory to its underlying Brent crude benchmark.

In terms of add-on costs, that to blend biodiesel (traditionally using methyl ester bioproduct) to the UK standard of 7% biodiesel (B7 specification) declined from above 4ppl to under 3ppl by the end of January, the lowest since mid-November 2023, limiting the increase in commercial bulk diesel prices.

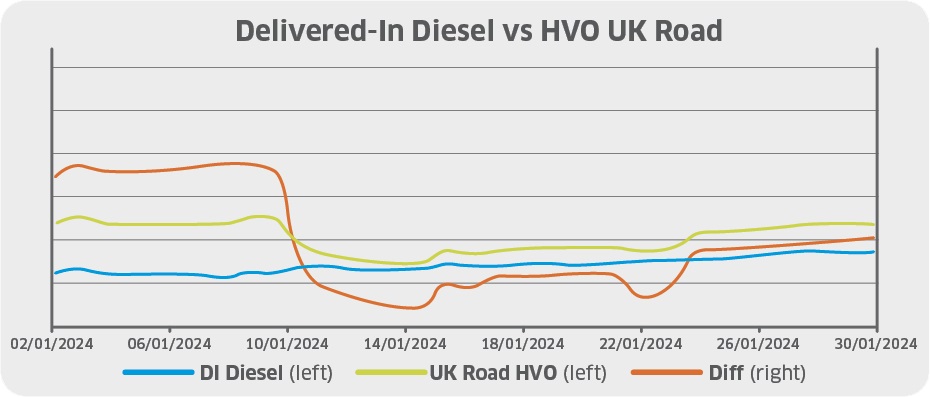

Finally, although wholesale renewable diesel (HVO) prices declined from c.124ppl to c.116ppl by mid-month, they recovered to close January unchanged at c.124ppl Additionally, the price of Renewable Transport Fuel Certificates (RTFCs) declined from around 19ppl to 16ppl by month-end, decreasing the benefit that HVO consumers receive.

As diesel prices increased moderately across January and wholesale HVO prices remained steady, the differential between the wholesale renewable diesel price and the delivered-in diesel price continued to narrow in January. However, note that this comparison is based on wholesale HVO prices and thus does not include any additional premiums. The assumption is also made that 100% of the RTFC benefit has been passed onto the end-user.

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information visit its website.