The beginning of July saw Saudi Arabia and Russia pledge further oil supply cuts for August, reducing output by one million and 500,000 barrels per day, respectively, adding pressure to the already constrained global oil supply.

A weak global economic outlook counteracted supply issues and balanced prices for the majority of July, until China announced plans to introduce stimulus measures to support its economic recovery, bolstering the demand outlook. As a result, oil prices rose across the month, reflected by Portland Pricing’s commercial bulk diesel index. It highlighted an 8% change, increasing by 9ppl and closing July at around 118ppl.

The United States showed signs of cooling inflation and a recovering economy, with the annual inflation report highlighting that US inflation rose at its slowest pace in more than two years in June. Labour costs posted their smallest increase in two years in Q2, with wage growth cooling. Therefore, investors expect the Federal Reserve to pause interest rates and end the fastest interest rate hiking cycle since the 1980s.

Meanwhile, the Bank of England is set to raise interest rates by 25bps to 5.25% in August, and the rates are expected to peak at 5.75% in November, down from previous projections of 6.25%.

This follows the latest CPI data revealing a reduction of inflation to 7.3% year-on-year growth compared to expectations of 8.2%, easing pressure on the Bank of England.

However, economists have warned that interest rates could still rise to 7% if inflation remains stubbornly high amid concerns that mortgage lenders have been increasing rates and withdrawing cheaper deals. Although sterling in June reached its strongest level against the US dollar since April 2022 at 131.2p, by the end of the month, GBP traded at 128.6p.

The cost of biofuels was virtually unchanged from the beginning to the end of July. For example, the cost to blend biodiesel to the UK standard B7 specification (7% biodiesel), typically using methyl ester bioproduct such as fatty acid methyl ester, remained at c.4ppl. However, biofuels costs peaked at almost 6ppl mid-month, partly contributing to the rise in commercial bulk diesel prices.

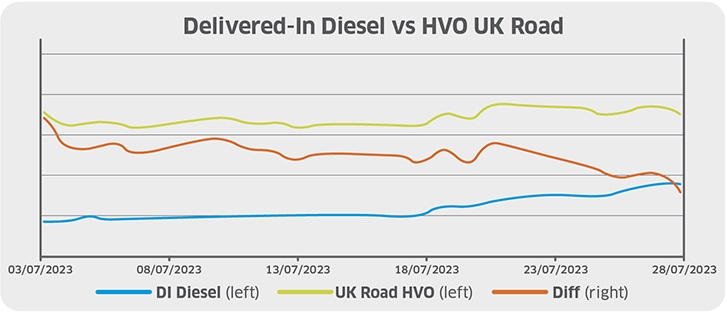

The price of renewable diesel (HVO) traded at 136ppl at the start of July, and despite falling to 132ppl by mid-month, it rebounded to 136ppl by the end of July.

The rise in the commercial bulk diesel price, alongside renewable transport fuel certificates increasing by c.3p during the month, has led to a narrow differential of around c.18ppl for the premium of renewable diesel over traditional fossil diesel – down from c.27ppl at the start of July.

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information, visit its website.