Oil prices in April were underpinned by geopolitical tensions, despite production in the Middle East remaining generally undisturbed. Brent crude futures began the month at US$88.90 per barrel, sitting almost 5% above the average for March.

News that an Israeli airstrike in on the Iranian embassy in Damascus had killed several Iranian military officials sparked tensions which would dominate the month’s events in the Middle East. The price reached a high of US$91.20 per barrel early in April, as markets prepared for Israel to retaliate.

Despite a tight supply environment caused by OPEC+ members extending voluntary oil output cuts of 2.2 million barrels per day in Q2 at their April meeting, the Brent price failed to break higher after Israel attacked Iran mid-way through the month. Iranian officials downplayed the retaliation, and oil prices began a downwards trend for the rest of the April.

The falling price of Brent crude, which closed the month at US$87.90 per barrel after rebounding slightly from a low of US$87.00, was driven by a weak demand outlook. United States economic data released in late April showed that the country’s economy only grew at 1.6% in Q1, below market expectations.

Also, the International Energy Agency reported that China’s oil use grew by an estimated 1.6 million barrels per day year-on-year in Q1, down from 1.9 million barrels per day in Q4 2023.

Poor demand indicators caused sustained downward pressure on oil prices throughout the month, and as the prospect of a ceasefire between Israel and Hamas looked increasingly positive, geopolitical risk factors from the Middle East gave way to demand concerns.

GBP began April trading at US$1.257, before rising modestly to a high of US$1.268 early on. However, the US Consumer Price Index data released in early April showed a hotter-than-expected inflationary picture. That caused traders to adjust bets on Federal Reserve interest rate cuts in 2024, resulting in the strongest week for USD since 2022, according to the Financial Times.

On the other hand, the UK saw stronger data released towards the end of the month, with British business activity in March seeing the largest increase since May 2023. This positive outlook has softened the stance of the Bank of England on potential rate cuts.

The general strength of USD and anticipated monetary loosening in the UK pushed the pound to a low of US$1.233 towards the end of the month, with GBP rebounding to close April trading at US$1.252.

The cost to blend biodiesel to the UK B7 specification decreased from 6ppl at the beginning of the month to 5ppl. That is because the wholesale cost of FAME-10 has fallen faster than wholesale diesel throughout April, so the differential has narrowed.

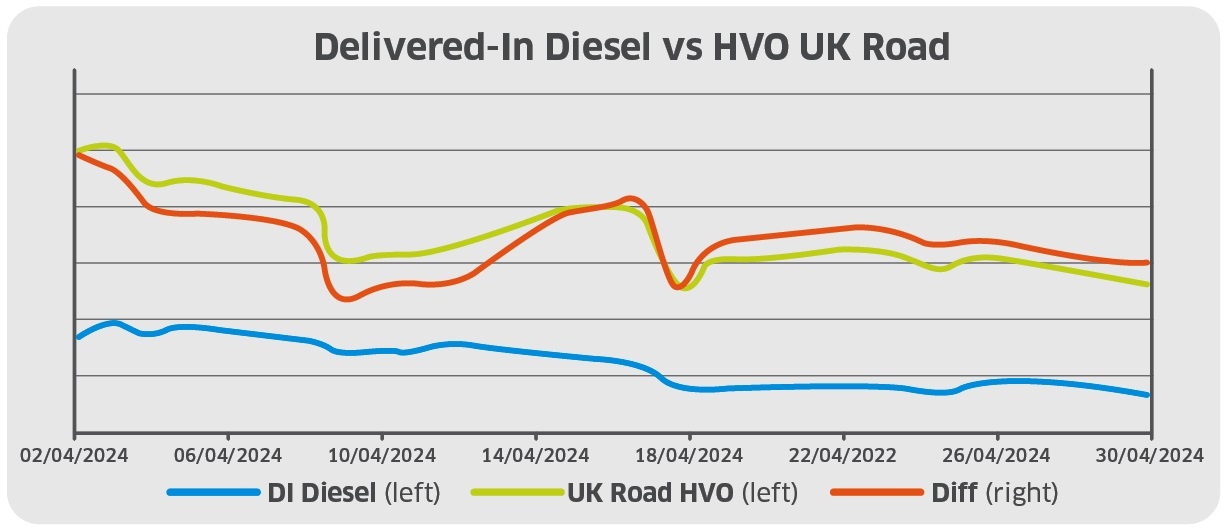

Finally, wholesale renewable diesel (HVO) fell from c.135ppl to c.124ppl in April. That is in part due to the price of Renewable Transport Fuel Certificates (RTFCs) rising marginally to 17ppl, slightly increasing the benefit that HVO consumers receive (assuming that 100% of the RTFC benefit is passed onto the end-user).

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information visit its website.