In August, the oil market experienced persistent OPEC+ supply constraints, with Saudi Arabia extending its output cut of one million barrels per day through September, alongside heightened oil demand, indicated by the US Energy Information Administration’s first report in August that showed a record 17 million barrel draw on US crude inventories.

An unstable geopolitical landscape caused increasing concerns of further supply disruptions and a brief spike in oil prices mid-month, with escalating conflict in Ukraine indicated by multiple drone attacks and President Zelenskyy threatening to retaliate if Russia continues to block Ukrainian ports.

However, supply constraints have been counteracted by the faltering economic recovery of China, exacerbated by weak imports and exports due to weak foreign and domestic demand. Across the month, oil prices remained virtually unchanged, and Portland Pricing’s index showed that commercial bulk diesel prices opened and closed August at 120ppl.

A mixed economic outlook continued throughout August, with the Bank of England raising interest rates for a 14th consecutive time from 5% to 5.25%, amid expectations of a 50bps hike due to high inflation.

The National Institute of Economic and Social Research stated that the UK is at risk of recession in 2024. However, the Bank of England claimed that recession can be avoided after data revealed that UK GDP rose by 0.2% in Q2 and the consumer price index measure of inflation fell to 6.8% in the year to July, down from 7.9% in June.

However, inflation still remained above the central bank’s target, and data towards the end of the month highlighted that UK business activity contracted more than expected in August, marking the largest contraction since January 2021.

Consequently, sterling declined marginally against the US dollar across the month, dropping by one cent to trade at US$1.267 by the end of August. Based on current wholesale diesel prices, a one-cent decline in sterling equates to an increase of less than 1ppl in the price of diesel.

The cost of biofuels also remained relatively stable across August, with the cost to blend biodiesel to the UK standard of 7% diesel (B7 specification) hovering between 4-5ppl and ending the month at just below 5ppl. Therefore, an unchanged biofuels price would not contribute to any movement in the commercial bulk diesel price.

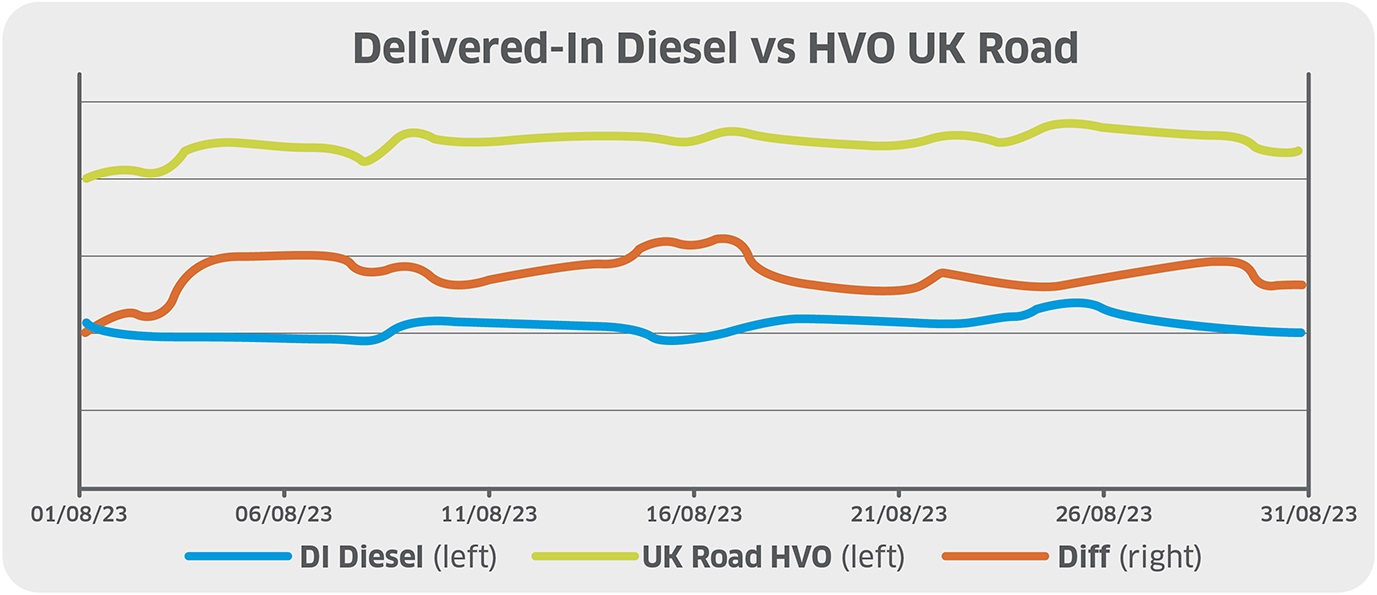

Finally, the price of renewable diesel – HVO – increased by more than 3ppl in August, from 141ppl to 144ppl. As the commercial bulk diesel price has remained the same, and Renewable Transport Fuel Certificates have increased by c.3p in August, the premium for renewable diesel over traditional fossil diesel widened from c.20ppl to c.23ppl by month end.

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information, visit its website.