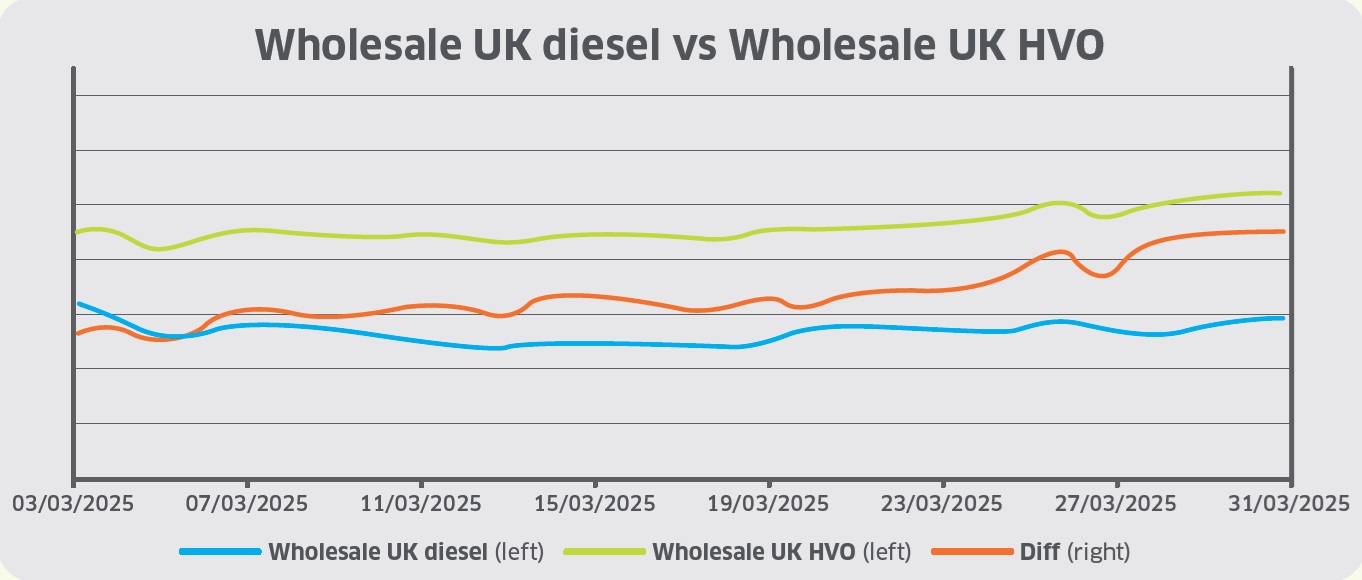

The wholesale UK diesel price declined from 54ppl (excluding duty) to 53ppl during March and broadly followed the underlying Brent crude benchmark, data from Portland has shown. US President Donald Trump’s tariff plans, particularly on imported vehicles, sparked concern over the effects of the tariffs on such purchases, and subsequently diesel demand growth.

Furthermore, data released by the Department for Energy Security revealed that the UK’s crude oil production rose for the third consecutive month during January, reaching the highest levels since May 2023.

Meanwhile, data also highlighted that the UK’s consumption of refined petroleum products declined by 2% compared to the year prior, with diesel demand falling by 12,250 barrels per day from December 2024’s levels.

Sterling appreciated from US$1.270 to US$1.291 throughout March, reaching a four-month high as uncertainty dominated US markets. Trump’s global tariff plans sparked concerns over the potential impacts of higher prices on demand growth as the President pledged to implement trade tariffs on imports from all US trading partners.

By mid-month, market attention turned to key monetary policy decisions whereby both the Bank of England and the US Federal Reserve held interest rates steady at 4.5% and in the range of 4.25-4.5%, respectively.

By month-end, sterling traded within the US$1.29-US$1.30 range following the UK Spring Budget, which revealed government spending cuts of £3.6 billion to adhere to fiscal rules. As sterling strengthened against the US dollar throughout March, UK wholesale diesel became marginally cheaper by 0.74ppl.

Wholesale UK renewable diesel (HVO) prices rose from 106ppl to 112ppl (excluding duty and Renewable Transport Fuel Certificate (RTFC) benefit) during March, underpinned by increasing cost pressures amid feedstock prices rising to three-year highs, particularly for used cooking oil (UCO).

Supply-side concerns mounted as markets awaited guidance by the Indonesian government on UCO export restrictions after it issued regulations to curb exports earlier in the year.

From mid-month, the UK initiated an anti-dumping investigation into HVO imports from the US following a request from several stakeholders on reports that the price cap had narrowed and HVO may now be directly competing with UK-produced biodiesel.

Furthermore, a feasibility study of conversion of Grangemouth oil refinery to a renewable fuel facility was carried out by EY on behalf of the UK government. It presented nine projects that could be integrated, with one proposal being a sustainable aviation fuel and HVO plant, costing £800 million. An outline of final recommendations is expected to be published soon.

In other news, North Ayrshire council has transitioned thirty-six refuse collection vehicles from diesel to HVO to support Scottish Government sustainability goals that include phasing out new diesel or petrol vehicles in public sector fleets by 2030. Reports suggested that the council’s transition could save around 2,529 tonnes of carbon emissions over 12 months.

Furthermore, Neste delivered its first load of HVO to a cruise terminal in Singapore, kickstarting Singapore’s path to decarbonisation amid various industry goals to reach net-zero emissions by 2050. In the European market, Aral has started offering HVO at two new filling stations in Germany to supply the HGV sector.

The cost of blending biodiesel to UK B7 specification rose from 6.9ppl to 7.1ppl throughout March. The cost of Renewable Transport Fuel Obligation (RTFO) compliance rose as the cost of FAME-10 increased by approximately 2% across the month.

In addition, RTFCs rose from 25 pence to 27 pence per certificate, thus increasing the benefit for HVO consumers (assuming 100% of the RTFC benefit is passed on the end-user).