Portland Pricing’s commercial bulk diesel index showed a fall of around 9ppl across March as fears of a global financial crisis following the collapse of Silicon Valley Bank threatened demand levels, while both the US Federal Reserve and the Bank of England raised interest rates in response to continued high levels of inflation.

National average delivered-in prices fell from a high of c.123ppl on 2 March to c.114ppl by month end as a result.

Falling biofuels costs also significantly contributed to the drop in price. Compliance with the Renewable Transport Fuels Obligation, the primary piece of carbon reduction legislation for the UK transport sector, is traditionally met by blending fossil product with renewable bioproduct.

For diesel, the bioproduct used is generally a methyl ester, such as FAME (fatty acid methyl ester) or RME (rapeseed methyl ester). The cost of blending to B7 specification (7% biodiesel, the standard specification in the UK) fell from around 7ppl at the start of March to c.4ppl by the final week of the month due to a drop in methyl ester markets, again linked to economic uncertainty.

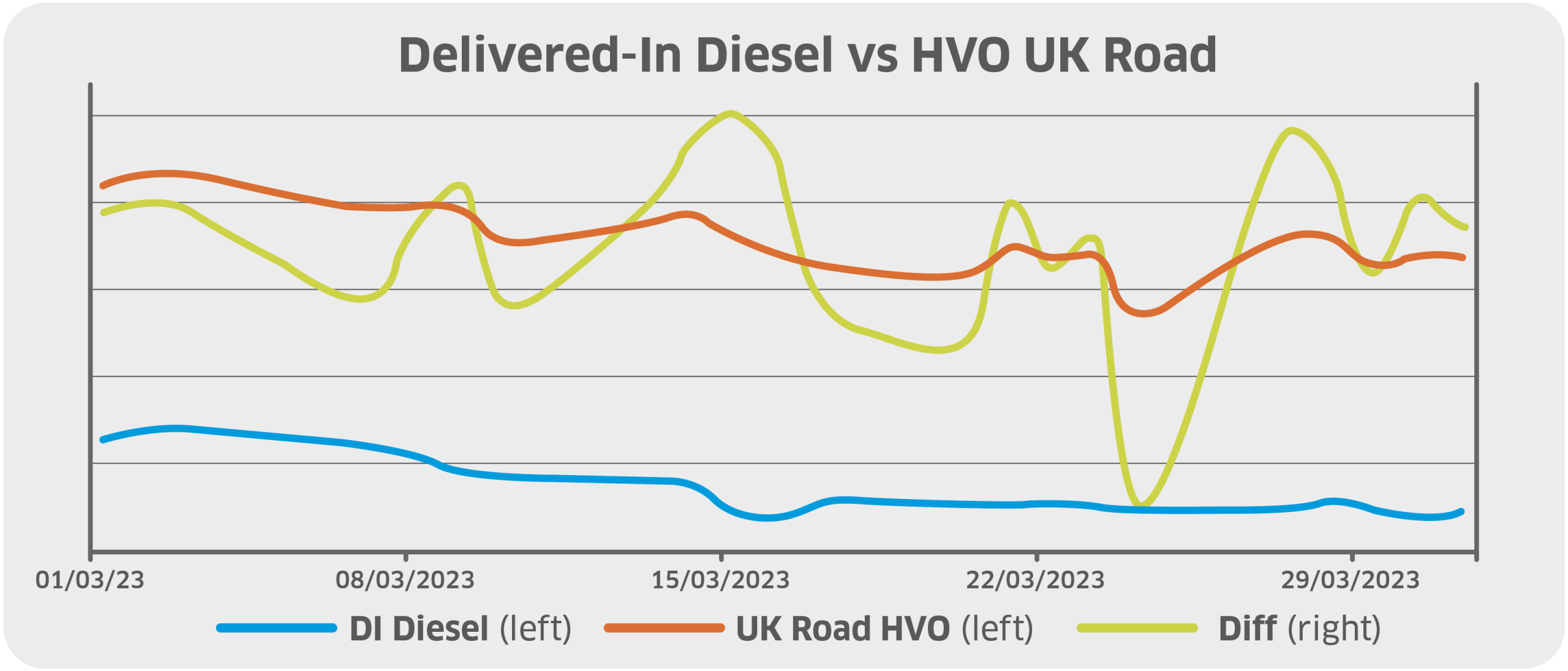

Renewable Transport Fuels Certificate (RTFC) prices followed suit, falling by around 10p per certificate across the month. As readers of our March routeone column will know, this has an impact on renewable diesel (HVO) pricing for end users in the UK.

While the differential between traditional and renewable diesel prices had initially been narrowing in March as wholesale renewable diesel prices declined at a faster rate than their diesel equivalent, the falling cost of RTFCs saw the differential widen in the final week of the month.

Portland Pricing is a specialist provider of transparent, independent fuel price information, covering both traditional and alternative fuels. For more information, visit its website.