Welcome back to Switched On. Having set out the key drivers of electric bus total cost of ownership and explored ways to minimise that in our previous articles, this month we are looking at retrofit in the form of repowering.

Electric retrofitting or ‘repowering’ is the process of replacing a vehicle’s driveline and engine with an electric drivetrain and battery, and it provides a unique opportunity to drive forward the decarbonisation of the sector.

This article sets out how and why – based on our experience of supporting over 1,000 battery-electric vehicles to date, including repowers.

As always, if you have any questions, do get in touch.

Steve Meersman, Co-Founder and Director, Zenobe.

Bus retrofit from diesel to electric: Repowering easy routes

While battery-electric buses reached 36% of new city bus sales in 2023 in the EU, with current vehicle life expectations, diesel buses could be on the roads until the 2030s at least. For many operators, the need to entirely electrify fleets today does not make financial sense when their current business model assumes diesel vehicle replacements in over a decade’s time.

Electric retrofitting, or repowering, is the process of replacing a vehicle’s driveline and engine with an electric drivetrain and battery, eliminating tailpipe emissions without writing off the asset early.

Several specialist companies, and now mainstream OEMs, are offering bus retrofit to electric. As with all zero-emission technology, the benefits of lower CO2 emissions and pollution are clear.

However, with retrofit vehicles also requiring less new materials to manufacture, their resource requirement is lower too – and so are the financial implications.

Repowered vehicles can be up to 50% cheaper than new electrics and the driveline can be installed in between four and eight weeks, depending on the vehicle type. With new electric vehicle delivery lead times as high as 12 months, operators that take advantage of this will not just gain a competitive edge at a lower cost but will help to accelerate the pace of electrification.

This may also ease new electric bus supply chain pressures as electric vehicle demand continues to grow. That said, repowering will not suit all vehicles nor all routes. In this article, we dig into which operators should be considering repowering their vehicles as a lower cost route to zero-emission today.

Starting with the basics

Repowering diesel vehicles to electric may not be suitable for all operators or routes, and there is a sweet spot in a vehicle’s lifecycle.

As diesel vehicles are phased out, it is crucial to choose the right moment to repower

Vehicles with at least five years’ lifetime remaining are most suitable for conversion to electric. It does not make sense to retrofit an end-of-life diesel or diesel-electric hybrid, as the cost to do so will be high relative to the remaining useful life of the vehicle.

It is clear that there will be a specific optimal window for repowering diesels, and we see this as being during the next five to 10 years.

Why? In five to 10 years’ time, the remaining diesel vehicles on the roads will be reaching the end of their lives and may no longer be appropriate for repowering. With half of all large buses purchased in the UK during 2023 being zero-emission models, and the UK targeting net-zero by 2050, most if not all the new vehicles being manufactured will be zero-emission or battery-electric leading up to this point.

That is not to say that the technology will become obsolete. Repowering will have further applications in other automotive industries where operators are looking to electrify their fleet, such as trucks and vans, and in other geographies, where the electric vehicle take-up has been slower.

The best use cases for repower define the operators it best suits

It is not just a question of when repowering makes financial sense, but for what – what types of routes, and thus which types of operators.

Overall, repowering best suits vehicles with lower mileages and lighter use. That includes tour buses, school buses, or regional buses – although the options do not stop there. An ‘easy life’ for vehicles is key.

That is because the original diesel bus has not been designed for electric and it may not have sufficient space aboard to hold as many battery units as a new electric bus. We have certainly seen this to be true when looking to electrify diesel double-deckers.

When a bus has a lower mileage per day/per charge or has a gap in its schedule for intraday charging, it does not need much battery capacity onboard. Due to their shorter routes and often inner-city operations, these vehicles often have longer lives and operate under ambitious decarbonisation and clean air goals.

Retrofitting these vehicles allows operators to maximise their electrification investment while meeting local transport legislation – for example, it can be an attractive option for those who only recently made the investment in Euro VI vehicles.

So if you’re a suitable candidate to choose repowering, what is the business case?

Retrofits are fast to rollout, and once one vehicle is retrofitted, the process becomes easier, more formulaic and faster to complete. By making the most of shorter wait times, you can keep pace or even overtake competitors.

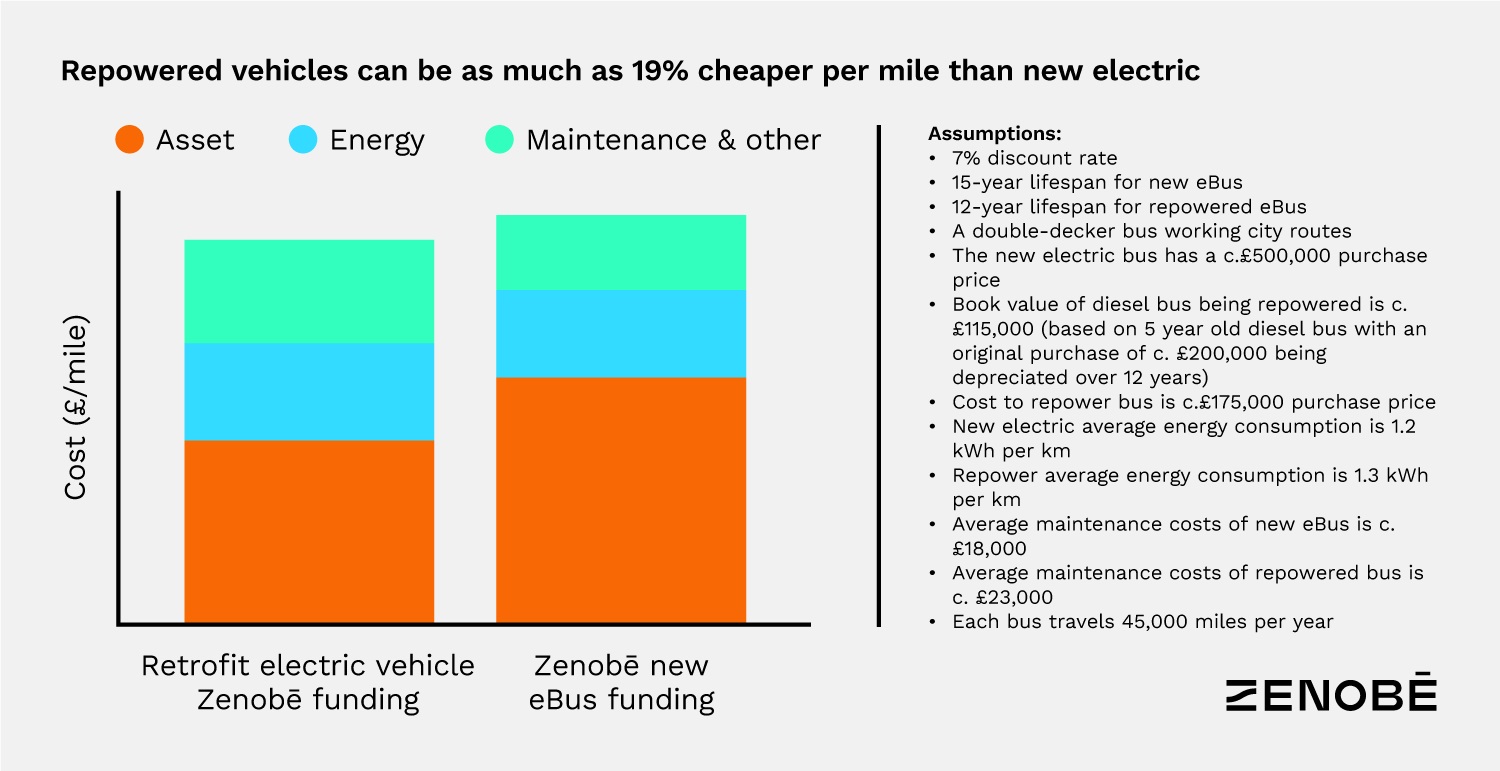

But it is not just about being able to deliver electric today. We anticipate that retrofits could be 10% cheaper than new electric vehicles over their respective lifetimes. This, however, is dependent on the operator’s depreciation profile of the diesel bus being repowered.

As in our first article where we examined the total cost of ownership (TCO) for diesel and electric vehicles, we have analysed the TCO difference between retrofitted vehicles and their new electric counterparts. See Fig. 1 and our assumptions below:

New technology naturally comes with risk

As a nascent technology, retrofitting carries greater performance risks compared to more established zero-emission technologies. However, the adoption of retrofit is accelerating, with increasing numbers of operators showing confidence in it.

To mitigate these risks, some retrofit companies offer scaled rollouts, providing demonstrator units initially and completing the full order only when specific KPIs are achieved.

These assets are also required to undergo thorough performance and safety testing by manufacturers and standards agencies. Schemes like the Zero Emission Vehicle Repower Accreditation Scheme, or ZEVRAS, from Zemo Partnership, ensure that operators get a higher standard of repower conversion, including an energy efficiency test and battery testing.

As more retrofits enter the market, retrofitters will further improve their solutions with user feedback and performance data. On top of that, operators will have more data available to make an informed decision about which vehicles in their fleets will be most suited to repowering.

The time is now

A market for retrofitting exists in tandem with the new vehicle market. We believe that now is the right moment for operators with the right service requirements to consider this as an option.

Why? The environmental benefits are compelling, with repowered vehicles immediately cutting tailpipe emissions, helping the environment by saving resources and cutting waste of existing vehicles. But as we have shown, the benefits can be financial too – making clean fleets accessible today.

As with everything in this transition, it is now a one size fits all approach. Let us know if you have a question about whether repower is for you.